Semiconductor Market Rebounds in 2024, Memory Leads the Charge

The semiconductor industry is on the path to resurgence, marking a promising turnaround from the downturn of recent years. Spearheading this revival is the memory market, propelled by the escalating demand for high-performance dynamic random access memory (DRAM) and high-bandwidth memory (HBM), both being fueled by artificial intelligence (AI) applications. As we delve into the trends and potential of this pivotal sector, we unravel the intricate dynamics driving the semiconductor industry’s comeback.

The onset of 2024 witnessed a gradual rebound from the cyclical downturn experienced in 2022 and 2023. This resurgence is notably propelled by exciting technological advancements, particularly in AI, which are spurring the demand and production of integrated circuits (ICs). The development of AI and automotive applications inherently relies on memory chips, resulting in a notable surge in sales in recent months. As the second-highest-selling category in the semiconductor industry in 2023, memory products are helping to lead the industry into recovery.

Beyond the Boom and Bust: The Enduring Demand for Memory

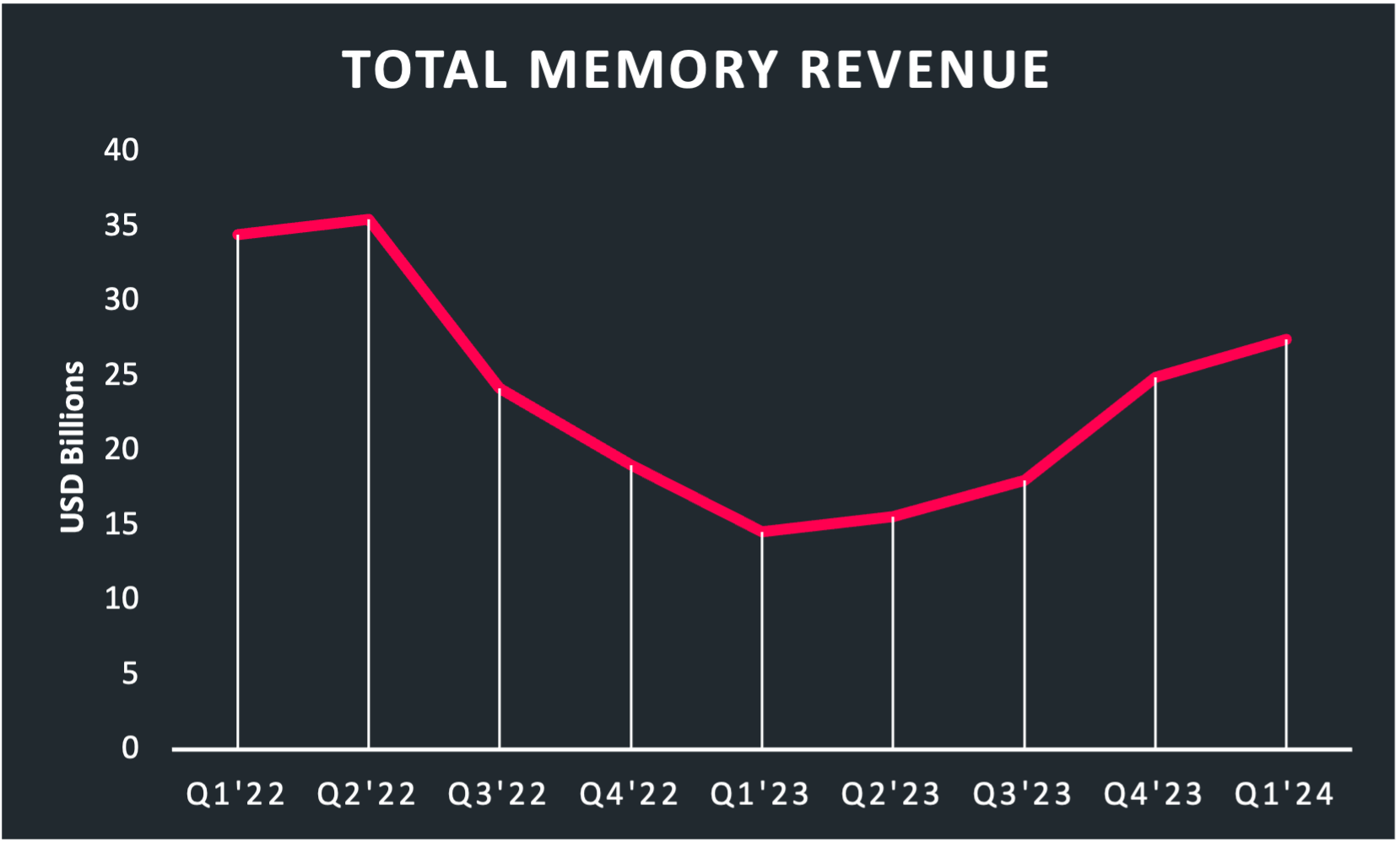

As the post-pandemic economy began its recovery, there was a significant spike in demand for electronic devices, prompting foundries to resume operations. A noteworthy milestone, the Semiconductor Industry Association (SIA) reported that total sales for 2022 reached a record-breaking $574.1 billion, the industry’s highest ever annual total for global semiconductor industry sales. However, the economy faced a setback in the latter half of 2022, leading to a halt in orders by companies and resulting in an overstock of chips for manufacturers. Within the memory market, poor sales of PC and mobile devices contributed to a significant oversupply of DRAM and NAND flash memory.

In response, memory companies initiated write-offs and production shutdowns, effectively stabilizing the supply of DRAM and NAND by the second quarter of 2023. Nonetheless, the semiconductor industry started 2023 with a weak showing. Data from the SIA showed global semiconductor industry sales continued to decline every month, with an average 20% decrease year over year. Although March marked the onset of month-to-month increases, the second quarter ended with a decrease of 17.3% in sales compared to the previous year’s second-quarter figures.

Fortunately, the semiconductor industry made significant strides toward recovery by the third quarter of 2023. Despite monthly sales remaining below the previous year’s levels, the gap narrowed. By November, global semiconductor industry sales managed to reach $48 billion, an increase of 5.3% over November 2022 and a 2.9% rise over October 2023. The year ended optimistically, though 8.2% lower than 2022, with total industry sales for 2023 amounting to $526.8 billion. Sales from Q4 2023 showed a promising 11.6% increase over Q4 2022.

The bulk of sales in 2023 comprised logic products, reaching a total of $178.5 billion, followed by memory products at $92.3 billion. Microcontroller units (MCUs) saw an 11.4% increase, totaling $27.9 billion, while automotive ICs experienced a remarkable 23.7% surge, hitting a record $42.2 billion. The industry’s path to recovery was undoubtedly influenced by the rise of AI.

Following ChatGPT’s public launch in November 2022, it swiftly gained traction, captivating not only everyday users but also more than 92% of Fortune 500 companies. Now, AI is seamlessly incorporated into various applications, including automotive, PCs, mobile, and other edge applications. As the chip industry mobilized to accommodate AI’s rapid expansion, memory chips emerged as pivotal players.

Total combined revenue (in billion USD) of the top three memory chipmakers: Samsung, SK Hynix, and Micron

The Road to Industry Recovery: AI Emerges as a Key Driver

AI was an undeniable presence in 2023, rapidly attracting new users and sparking competition between companies to introduce their AI models. A clear result of this boom is the rise of Nvidia, the top AI chipmaker, which reached $1 billion valuation in 2023. AI growth is in full sprint, and the demand for increased computing power and faster memory response is urgent. This brings memory makers to the forefront, but it also highlights a challenge: the memory wall.

The memory wall refers to the disparity between advancements in processing power and memory. While processor performance has been improving rapidly, memory has not caught up, and this gap is widening. Consequently, data retrieval from memory is delayed, which escalates as the processor performance increases. This imbalance reduces power efficiency as the processor idles while awaiting data, hampering its full utilization.

The memory wall poses a significant challenge for AI’s processing demands. High-bandwidth memory is required to store and retrieve data necessary to support the latest AI models. This signals memory as a market driver, with AI-enabled PCs and other edge applications. Currently, the industry is prioritizing next-generation DRAM and fifth-generation double data rate synchronous dynamic random access memory (DDR5 SDRAM) for advanced applications. DRAM is essential for computers, mobile devices, and now AI servers, which is why companies like SK Hynix saw a rise in their premium DRAM memory sales in the fourth quarter of 2023. This included DDR5, a high-density product often used in AI central processing units (CPUs), which quadrupled in sales year over year.

SK Hynix performed even better with HBM3, achieving a staggering fivefold increase in sales in Q4 2023 compared with Q4 2022. High-bandwidth memory stands out for its superior density and power efficiency and is a preferred choice for AI servers and data centers. Amid fierce competition between SK Hynix, Micron, and Samsung, TrendForce projects HBM to capture 20.1% of the DRAM market by the end of 2024. Notably, SK Hynix and Micron have already sold out their respective HBM supplies for 2024 and much of 2025, highlighting the soaring demand for this cutting-edge technology.

Besides AI, memory sales are being driven by mobile phone makers. The International Data Corporation recently reported a 7.8% increase in smartphone shipments year over year in Q1 2024, a positive sign for memory companies. With the mobile industry’s return and AI’s momentum, memory chips are poised to continue spearheading recovery and fostering innovation within the semiconductor industry.

The Future of the Memory Market: Innovation and AI Integration

While the semiconductor industry’s global landscape is intricate and unpredictable, its cyclical nature and the vital role of memory products persist. The ongoing challenge of the memory wall serves as a perpetual catalyst for memory innovation. As AI expands its footprint across diverse applications, the demand for high-performing HBM intensifies to handle burgeoning data volumes. And, with the return of mobile phone demand and the exponential growth of AI, memory chips are poised to remain at the forefront, driving recovery and innovation in the semiconductor sector for years to come.