Since 2015, China’s artificial intelligence (AI) industry has developed rapidly through the promotion of a wide range of technologies. From basic hardware, such as chips and system platforms, to algorithms and models, covering agriculture, industry, commercial, medical, transportation and other industrial services, there are thousands of companies in the overall AI industry chain. According to data from EqualOcean Intelligence, a Chinese market research organization, the market size of China’s core AI industry reached 135.1 billion yuan (about US$19.4B) in 2021 and is predicted to grow to 400 billion yuan (about US$57.5 billion) by 2025.

Among the thousands of Chinese AI companies, more than 80% are focused on application solutions, including CPUs, GPUs, graphic FPGAs, ASICs and SoCs. The technological capabilities of these developers vary substantially. Overall, Chinese IC manufacturers are using general-purpose chips for cloud AI training and inference, which require sizeable computing power. Development progress is relatively slower in this sector due to restrictions created by U.S. sanctions on China and geopolitical factors, which make it difficult for Chinese companies to obtain EDA tools, advanced semiconductor process equipment, and manufacturing capacity. However, there is more significant progress in the development of exclusive chips for such vertical applications as autonomous driving, robots, smart security, and smart homes. In its 2022 China Artificial Intelligence Chip Industry Research Report, EqualOcean reported that China’s AI chip market is expected to reach 178 billion yuan (about US$25.6B) in 2025 from 42.68 billion yuan (about US$6B).

Despite stricter controls during 2020-2022 due to China’s zero-COVID case policy, investment in AI chips remained active. According to EqualOcean, although investment in China’s AI field decreased in 2022, the overall scale of investment continues to trend upward. There were 92 fundraising cases in China’s chip industry in 2021, worth about 30 billion yuan (about US$4.3B). Companies in the AI chip industry that have entered A round or higher fundraising include Enflame, MetaX, Shanghai Tianshu Zhixin Semiconductor, Biren Technology, Horizon Robotics, Aivatech, NebulaMatrix, HOUMO.AI, Corigine, Shanghai Analogic Infotech, Vastai Technologies Inc., YUSUR Technology, Moffett AI, and Smartic AI, to name a few.

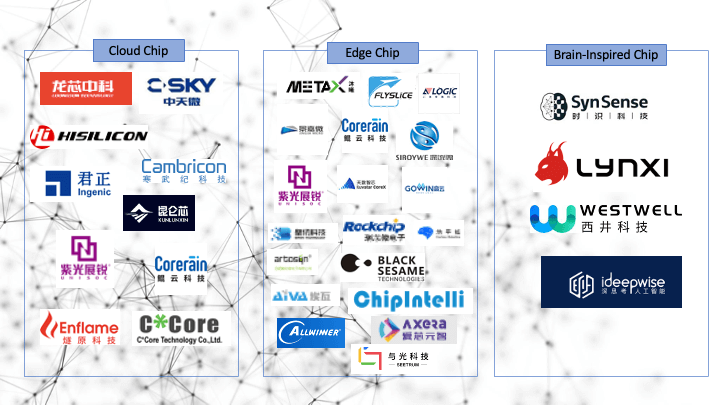

Other companies that have launched actual products and established market awareness in China’s AI chip field include Artosyn, Kunlun Xin (formerly Baidu’s AI chip department), Cambricon, Black Sesame Technologies, and SynSense. Some established IC design companies have also entered the AI cloud or edge application market; examples include C-Sky Microsystems (acquired by Alibaba Group), Hisilicon, Ingenic, UNISOC, Allwinner, and Rockchip. More details can be found in Figure 1. In addition, the latest “Silicon 100” list of start-up companies published by EE Times in 2022 mentions Chinese firms Eswin Technology, Tsingmicro Intelligent Technology, Moore Threads Technology, SemiDrive Technology, T-Head, Reexen Technology, and Zhaoxin Semiconductor as market rookies in the AI chip development space that are worthy of attention.

Figure 1

Despite active investment and numerous participating manufacturers, China’s AI chip industry still faces some challenges to continue developing and keep pace with European and American companies. It is still difficult to obtain EDA design tools that rely heavily on imports and advanced manufacturing processes and equipment below 14 nanometers. in addition, the combination of AI chip hardware and software algorithms and the lack of talent in related companies create further bottlenecks that must be overcome. For this reason, the Chinese government has introduced policies related to talent cultivation and introduction. In addition, government and industry are working together to cultivate talent through the industry-university cooperation model. From 2018 to 2021, AI-related courses were offered in more than 300 universities and colleges, a trend which continues today.